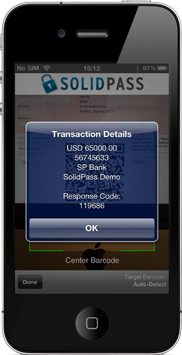

Transaction Data Signing (TDS) Security Token

The SolidPass™ security token supports Transaction Data Signing (TDS). This allows the user to authenticate the transaction with a challenge issued by the enterprise and a response generated by SolidPass™ based on the transaction details. The response that is generated becomes the unique digital signature that once processed allows the transaction to go through. SolidPass™ validates the signature against the transaction data and executes the transaction.

SolidPass also supports the following authentication methods:

- Event-based One-Time Password (OTP)

- Time-based One-Time Password (OTP)

- PIN control mandatory/optional

- Security Question

- Challenge-Response

- Mutual Authentication

TDS can be used to prevent the following attacks:

- Man-In-The-Middle

- DNS Cache Poisoning

- Trojans

- Man-In-The-Phone

- Browser Poisoning

Mobile Token Convenience

The key advantage of the mobile token is that there are no new devices or wallet-fillers for customers – just an add-on to the device they already carry everywhere. Since customers already own the “hardware” (the mobile phone), SolidPass can be provided and managed at a fraction of the true cost of a hardware token solution. Thanks to its flexible framework, the application can also be updated to guard against new security threats.

SolidPass works on a number of different mobile platforms (both feature and smartphones). Solidpass mobile tokens include the following:

- Android

- Blackberry

- Brew

- iPhone

- Java ME Token Event-based (J2ME)

- Mobile Linux

- Palm

- Symbian

- Windows Mobile

Desktop Soft Token

SolidPass also supports desktop-based software tokens as well. The Desktop Operating Systems and Browsers supported are:

- Toolbar Token

- Java Token

- Linux Token

- Mac Token

- Windows Token

TDS Embedded

TDS can be embedded in mobile applications such as mobile government. Thus strong authentication can be built into standalone applications. This especially useful for mobile banking security, where TDS can be embedded in a mobile banking application for seamless authentication.

Regulatory Compliance

Regulatory requirements are pressuring organizations to adopt

stronger authentication methods and to secure access to data

systems and applications. Static username/password

identity management no longer provide enough security to

authenticate users accurately. This has led to adopting

two-factor authentication systems. Legislation from the

Sarbanes-Oxley Act (SOX), guidelines from the Federal

Financial Institutions Examination Council (FFIEC), and

recommendations from the Health Insurance Portability and

Accountability Act (HIPAA) all require that organizations use

stronger forms of authentication to mitigate data theft,

prevent fraud, protect customer information and patient

privacy. SolidPass helps organizations and enterprises

comply with regulatory regimes that cover authorization rules

and auditing protocols.

In addition to non-compliance,

organizations that continue to use static username/passwords

face numerous problems ranging from brute force attacks,

dictionary attacks, guessing and social engineering.

OATH Compliant Event-based Tokens

As a member of the Initiative for Open Authentication, SolidPass 2FA tokens are built OATH compliant.